The Psychology of Market Cycles in Crypto and How to Avoid Emotional Trading

Posted on 10 Jan 2025

Understanding Market Cycles

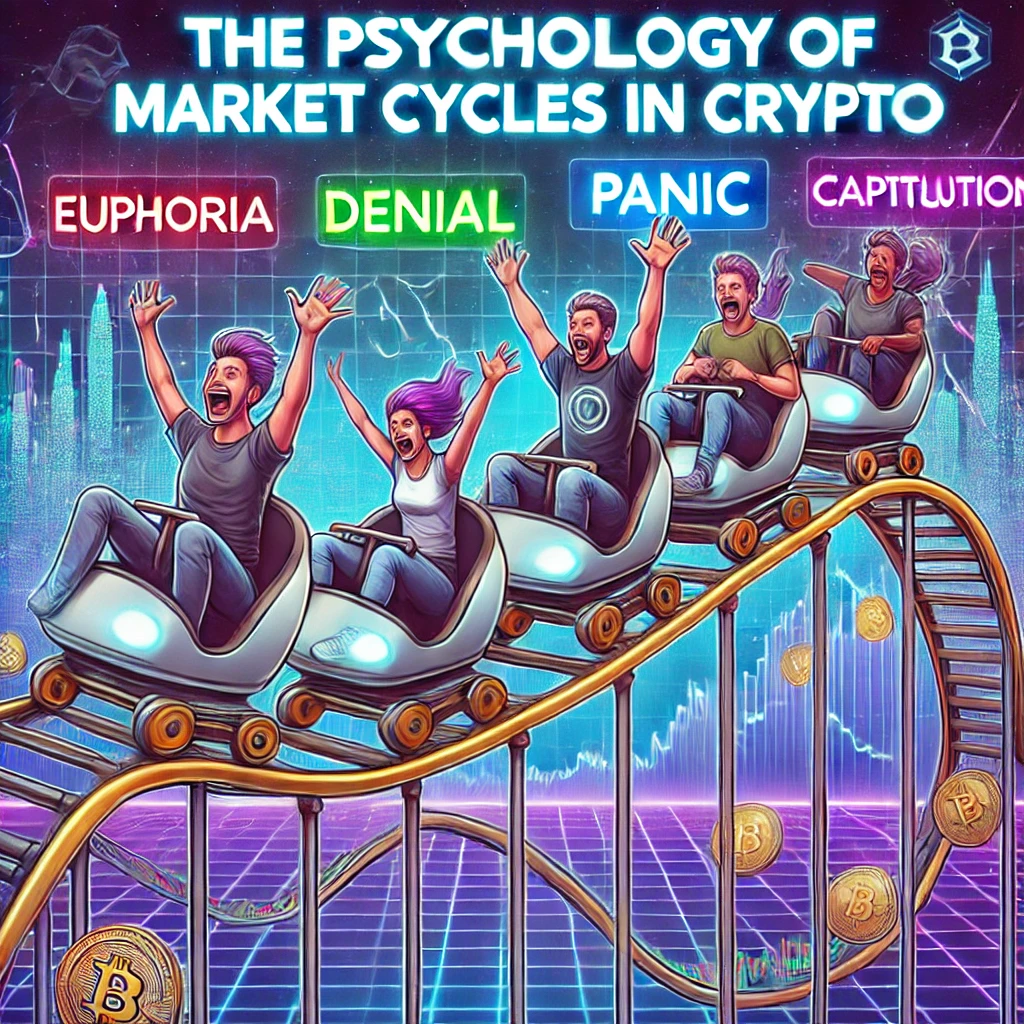

Cryptocurrency markets, like traditional markets, go through cycles driven by investor emotions. These cycles typically consist of four phases:

1. Optimism and Euphoria (Bull Market)

During a bull market, prices rise, and investors become overly confident. New investors rush in due to FOMO (fear of missing out), driving prices even higher.

2. Anxiety and Denial

At the peak, early investors start taking profits, causing volatility. Some traders believe the market will keep going up, ignoring warning signs.

3. Panic and Capitulation (Bear Market)

As prices fall, panic sets in. Many investors sell at a loss, leading to a further decline. The market sentiment turns negative.

4. Recovery and Hope

Eventually, the market stabilizes, and smart investors start accumulating assets at lower prices. Confidence slowly returns.

How to Avoid Emotional Trading

- Have a Strategy: Set clear entry and exit points before investing.

- Avoid FOMO and Panic Selling: Stick to fundamentals rather than emotions.

- Diversify Your Portfolio: Don't invest all your capital in one asset.

- Use Dollar-Cost Averaging: Invest gradually instead of all at once.

- Stay Informed: Follow reliable news sources and avoid hype-driven speculation.

Conclusion

Understanding the psychology of market cycles helps investors make rational decisions. By staying disciplined and managing emotions, traders can navigate crypto markets more effectively.